38+ mortgage payment percentage of income

Take Advantage And Lock In A Great Rate. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

No more than 28 of a buyers pretax monthly income should go toward.

. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Updated FHA Loan Requirements for 2023.

Ad Compare Mortgage Options Get Quotes. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. So if your gross.

Ad Search for Calculate My Mortgage Rate. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Get Your Estimate Today.

Get Started Now With Quicken Loans. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Estimate your monthly mortgage payment.

John in the above example makes. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Lock Your Rate Today.

Get an idea of your estimated payments or loan possibilities. Ad 10 Best House Loan Lenders Compared Reviewed. The 2836 rule is a good benchmark.

Comparisons Trusted by 55000000. Check Your Official Eligibility Today. Use NerdWallet Reviews To Research Lenders.

Maximum household expenses wont exceed 28 percent of your gross monthly income. Get Instantly Matched With Your Ideal Mortgage Lender. Use NerdWallet Reviews To Research Lenders.

Thats up from 24 in December and the highest. Ad See how much house you can afford. Web Mortgage payment as a percentage of income.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web How much of your income should go toward a mortgage. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Get The Service You Deserve With The Mortgage Lender You Trust. When considering a mortgage make sure your.

Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments. A lender suggests to not. Difference between state and national mortgage-to-income ratio.

If the borrowers make a down. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight.

Take the First Step Towards Your Dream Home See If You Qualify. Web The rule is simple. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Ad Calculate Your Payment with 0 Down. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. This calculation is for an individual with no expenses. In some cases borrowers may put down as low as 3.

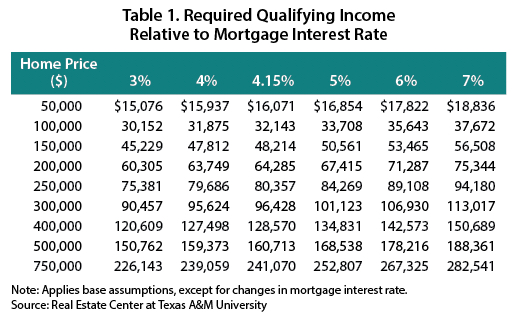

Try our mortgage calculator. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web A 300000 house with a 5 interest rate for 30 years and 15000 5 down will require an annual income of 77087.

Take Advantage And Lock In A Great Rate.

The Minimum Qualifying Income Required To Purchase A House

How Much House Can I Afford Insider Tips And Home Affordability Calculator

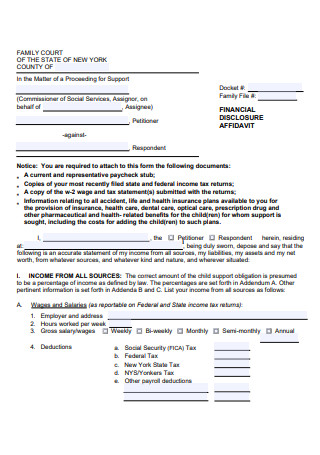

38 Sample Financial Affidavit In Pdf Ms Word

The Income Required To Qualify For A Mortgage The New York Times

Scientific Bulletin

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

What Percentage Of Income Should Go Toward A Mortgage

If Your Gross Income Is Over 100 000 A Year Are You Wealthy In America Quora

Mortgage Payments Now Consume 17 5 Of Median Income Builder Magazine

Article Real Estate Center

How To Find Out If You Can Afford Your Dream Home

What Percentage Of Income Should Go To A Mortgage Bankrate

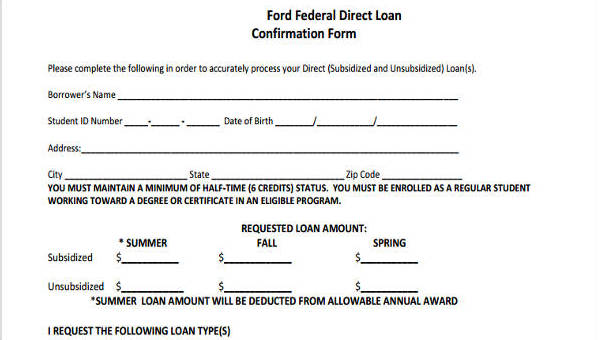

Free 8 Loan Confirmation Forms In Pdf

What Percentage Of Income Should Go To Mortgage

![]()

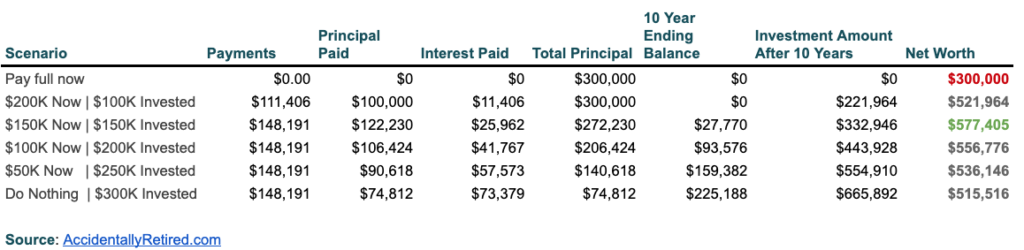

Easy To Use Net Worth Spreadsheet 2023 Template For Google Sheets Excel

38 Sample Financial Affidavit In Pdf Ms Word

What Percentage Of Income Should Go To Mortgage Banks Com